What price DOMA,

Duct Tape, and a

Designated Deity?

My question to America's Backside Of The Bell Curve:

Are you happy yet?

The US is engaged in a jingoistic morality war by BushCo design...

As long as The Backside Of The Bell Curve is busy hating gays, duct taping their homes against a Shadowy Muslim Menace, and choking the Heathens Among Us with their fascist fundie version of Jeeezzzuusss, BushCo can bomb, torture, and pillage at will.

So I repeat...

Are you happy yet?

I certainly hope so.

Because the rest of us are feeling the BushCo love where it hurts the most: in our back pocket nether regions...

Namely, in the wallet.

Ahem.

"We cut taxes, which basically meant people had more money in their pocket."

George W. Bush

2/12/04

George W. Bush

2/12/04

In this year of the common era, 2005, 88% of us will save $100 or less on our federal income tax bills. LINK

And BushCo thanks you sincerely for sucking at math!

You all know by now that the rich are enjoying almost all of the BushCo Income Tax Relief rewards.

But what about the rest of us?

Explain this...

TAX INCREASES FOR EVERYONE

President Bush's 2004 budget proposed an increase of $5.9 billion in fees on taxpayers from just one year ago. In 2005, the Bush budget assumes the "government will take in 13% more in taxes and fees next year than in fiscal 2004."

Where's that money coming from?

And while you're at it, explain this, too...

And while you're at it, explain this, too...

STATE TAX INCREASES (Blame the BushCo budget!)

3% decrease to federal grants to states

$16 billion decrease in state tax revenues

$23-$82 billion in unfunded mandates

"Millions of American individuals and businesses face tax hikes this year... wiping out the savings that some taxpayers would otherwise see on their federal 1040."

Which has caused millions of Americans who HAVEN'T OUTRIGHT LOST THEIR HOMES to do this:

But that's OK because BushCo can now claim that housing sales are Up! Up! Up!

Now try this on for size...

Since President Bush took office, states have raised taxes by a total of $14.5 billion, after 7 consecutive years of cutting taxes. The total 2003 net tax increase was $6.9 billion for the 42 reporting states – following a 2002 net tax increase of $9.1 billion.

But Wait! There's More!

Seventeen states raised taxes by more than 1%.

Four states raised taxes by at least 5%.

TAX INCREASE ON STUDENTS AND THEIR FAMILIES

Since President Bush took office, state colleges and universities across the nation imposed their "steepest tuition and fee increases in a decade."

In the 2003-04 academic year, college tuition and fees increased an average of

$579 at public universities

$1,114 at private institutions

$231 at two-year public colleges

Bush's latest budget also proposes to "prohibit agencies from waiving a 1% Stafford Loan fee and forces students to collectively pay $1 million in interest each year."

TAX INCREASE ON VETERANS

"Two years after tripling the co-payment that veterans pay for prescription drugs the Department of Veterans Affairs wants to raise it again."

President Bush's 2005 budget would increase prescription "drug co-pays from $7 to $15 for many veterans." In 2002, the co-pay went from $2 to $7."

PROPERTY TAX INCREASES (Those Pesky Unfunded Mandates)

The Administration has left a $9 billion hole in funding its own education bill.

"County and city governments have been raising taxes" with "property tax collections rising more than 10%" last year alone

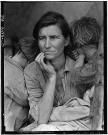

TAX INCREASE ON LOW-INCOME FAMILIES & KIDS

According to the National Association of State Budget Officers, 32 states have effectively increased taxes on low-income families by raising their Medicaid co-payments.

"50 states reduced or froze payments to Medicaid providers, 34 states have reduced or restricted Medicaid eligibility.

35 states have reduced Medicaid benefits."

In Florida, for instance, deficits caused by tax cuts have left more than 80,000 kids on waiting lists for health care.

Overall, because of these tax Medicaid fee increases and deficits, 1.7 million people could lose minimum health coverage.

TAX INCREASE DUE TO MEDICARE DRUG "BENEFIT" REFORM

$319 for joint filers

$93 for head of household

$128 for single filers

$186 for all filers

Adding this into Medicare's current projected shortfall, the [tax increase] total becomes (LINK):

$1,168 per household in 2010

$2,262 per household in 2020

$3,980 per household in 2030

TAX INCREASE ON USERS OF PUBLIC PARKS

The Bush Administration proposed to make "entrance fees at some national forests and parks permanent, opening the door to new charges at some locations."

TAX INCREASE ON SMALL BUSINESSES

The Bush Budget proposes to eliminate funding for the Small Business Administration's "flagship 7(a) loan program" – a program "which backs 40% of all long-term lending to the country's small businesses" – and instead fund it by a massive fee increase on borrowers.

President Bush's supposed "small business tax cuts" leave roughly 96% of small business with almost nothing.

TAX INCREASES TO COME (Thank BushCo's Deficit!)

Reagan supply side guru Bruce Bartlett "is beginning to sound the alarm that Bush's tax-less, spend-more budgets are unsustainable and will force the president to raise taxes." As he says, "These tax increases, when they come, are the result of conscious deliberate decisions this Administration made." His bet for next year or the year after: "A tax increase of more than $100 billion a year." LINK

STATE FEE INCREASES ARE SKYROCKETING

A simple Google search on "State fee increase" returned 15,900,000 hits. See for yourself (LINK).

Examples:

As a result of the governor's recommendation and the legislature's decision (Kansas) to make the Secretary of State's office a fee-funded agency, we increased our fees on September 1, 2003.

Historically, half of our agency's revenue was generated from state general fund dollars, and the other half was generated by fees charged for services. This year general funds were cut by 50 percent. In fiscal year 2005, we will receive no state general fund money.

--snip--

We regret the new fee structure will affect our customers, but we hope you will understand. You may refer to Senate Bill 239 for specific details on the fee increase. Please contact us with any questions at (785) 296-4564.

***

RENO -- A proposed 43 percent increase in state brand inspection fees is drawing opposition from Nevada ranchers.

The Nevada Cattlemen's Association said the increase from 70 cents to $1 per animal is too much for an industry that's still rebounding from a nearly decade-long slump in cattle prices.

Under the plan, the fee would jump from $700 to $1,000 for a rancher to have 1,000 head of cattle inspected before being sold or shipped out of state.

***

This legislative session, ADF&G will seek an increase in sport fishing and hunting/trapping license fees in order to protect and enhance sport fishing and hunting opportunities in Alaska. (Oh Right Sure!)

***

Student Fee Increase (Ohio) begins with Spring, 2005

Effective for the Spring, 2005 Semester, the "Student Fee" will be increased to $30.00 and Parking Tags will be issued.

***

It's way past time for the GOP to change its elephant logo to...

Google "Your State and fee increase" or "Your State and tax increase" or "Your State and unfunded mandate" and tell me that gay bashing, duct taping your ranch style (located in a former BFE Red State cornfield), and demonstrating the Pure D Weakness of your own faith by forcing the rest of the country to wave its collective arms in some kind of mass-hypnotic fervor is truly worth jeopardizing your family's ability to enjoy the health and prosperity the BushCo set is currently robbing you and yours of.

By the way, never end a sentence with a preposition.

And always credit google.com for any images you use on your blog. I don't do that often enough.

0 Comments:

Post a Comment

<< Home